Last year, 42 million consumers suffered a staggering $52 billion in losses from identity fraud. Just when you think there can’t possibly be a silver lining – we found one. Much of this activity is happening via “traditional ID fraud” – the kind that happens in a way the consumer may never know, like a data breach. The other form of identity fraud happens as part of a scam (when a criminal directly deceives someone into giving sensitive information. Victims and losses dropped significantly from last year, with 12 million fewer victims (at 27 million total) and $15 billion less in losses (for a total of $28 billion).

While the numbers are still outrageous, it suggests that consumers have adopted stronger protections that have put a big dent in the success of identity fraud scams.

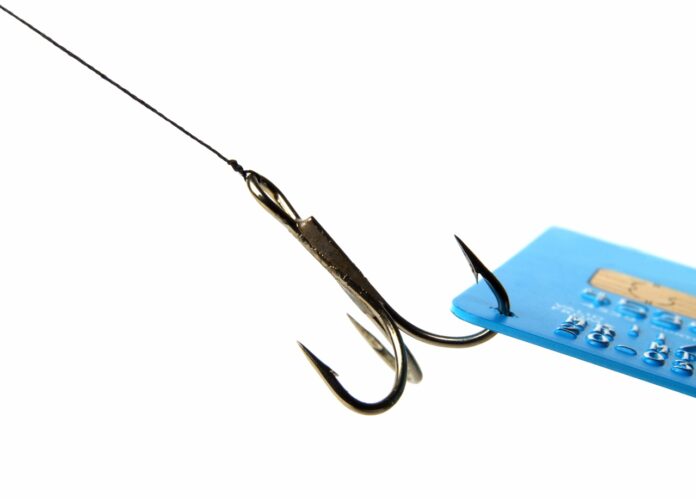

The best offense is a good defense: avoid clicking on links in text messages or emails, use unique passwords for each website you do business with; enable two-factor authentication, which requires a password and a separate code to access the website; and avoid scanning unknown QR codes – it may take you to a malware-infested web addresses.

Be a fraud fighter! If you can spot a scam, you can stop a scam.

Report scams to local law enforcement. For help from AARP, call 1-877-908-3360 or visit the AARP Fraud Watch Network at www.aarp.org/fraudwatchnetwork.