Many now feel the pain of inflation while buying daily items like gas, restaurant meals and groceries. However, there is also another, often hidden strain: soaring house assessments. For homeowners, rising values might initially make them feel good, adding to their net worth. However, homeowners don’t realize the gain until they sell… and then where will they live?

Moreover, soaring house prices makes it harder for first-time buyers to purchase a house, adding to the concern that current policies are turning Americans into a nation of renters.

All this takes a deeper bite out of wallets. Even if a locality keeps its real estate tax rate the same, the increased assessment drives the tax bill up. In early 2024, some irate Franklin County property owners were sharing photos on social media of their assessments shooting up 100% or more over three years. Thus for those residents, if Franklin County keeps its rate the same, the tax bills for those individuals can easily double.

Some Botetourt conservatives have been so upset about the County’s direction, over 500 residents attended a recent mass meeting and by a narrow 554-570 margin voted for a new County GOP Chairman, Steve Dean.

Renters suffer too, because as landlords have to pay more in real estate taxes and see the value of each dollar diminishing, they simply pass along those costs by raising the rent.

Inflation is defined as “too many dollars chasing too few goods,” which is fueled as the federal government keeps printing more money and adding to the national debt, now at $34.6 trillion. As reported here, here and here, Virginia’s US Senators Tim Kaine and Mark Warner consistently vote to keep adding to the national debt.

Inflation is so pervasive but stealthy, it has been labeled a kind of hidden tax or even a “silent thief.”

Economists John Maynard Keynes claimed, “By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” Milton Friedman states, “Inflation is taxation without legislation.” George Mason University Economics Professor Walter Williams even claims, “Printing new money to introduce into the game makes me a thief.”

The Vinton Magisterial District of Roanoke County is now a political hotspot, with many signs for Tammy Shepherd or Tim Greenway dotting yards and roadsides. As reported here, the County Board of Supervisors appointed Shepherd from a field of candidates to represent the Vinton District. The supervisors did that to fill the seat vacated by Jason Peters who won his race for Commissioner of the Revenue and made history by defeating the County’s last Democrat office-holder and turning Roanoke County all red.

Shepherd’s appointment is only for 2024, so now she is running for the June 18 GOP primary against Tim Greenway, who presently represents the Vinton District on the School Board. Both are lifelong Vinton residents who enjoy widespread name recognition. Both are also realtors, so they have a professional connection to the issue of property assessments.

Whoever wins the June primary will then have their name on the November ballot as the Republican candidate to run for another one-year term, only 2025, which will finish the remainder of Peters’ original term. Since Roanoke County is increasingly Republican, it’s believed whoever wins the June primary will win the general election in November.

Since inflation and property taxes are hot topics, The Roanoke Star reached out to both candidates for more information.

To Roanoke County’s credit, the Board of Supervisors has reduced the real estate tax rate twice. (In contrast, the Cities of Roanoke and Salem, have not, keeping their rates the highest in the Valley.)

On April 11, 2023, as reported here, the County Supervisors announced a rate cut from $1.09 to $1.06, among other tax cuts.

By email, Shepherd stated the “Board approved $1.04 tax rate […] on April 9, 2024.”

Though helpful and in the right direction for taxpayers, the two-cent rate drop is a 1.89% reduction. Put another way, if homeowners saw their assessment go up by 2% or more, they will still be paying a higher total tax.

Still, Roanoke County itself is also a victim to inflation, because the administration has to pay more for almost everything, from roads to parks to hiring and retaining quality employees. Moreover, as Democrats at the state and national levels have moved to shut down coal-burning electric plants, gas pipelines, etc., those policies not only drive up costs for normal residents but also for local governments, that must pay electric bills, put gas in school buses and police cars, etc.

On a plus side, Roanoke County is known for providing more services than surrounding rural counties do, more public safety and order than Roanoke City does, and it’s also the only county in the whole state that provides curbside trash pickup without mandating an extra fee.

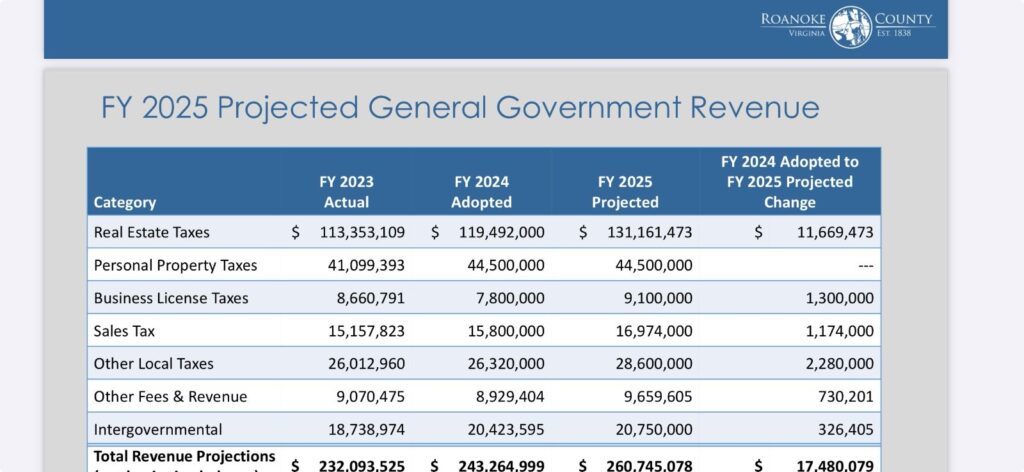

The Roanoke Star (TRS): Even at the $1.06 rate, about how much additional “windfall” or revenue has the County received, as a result of HIGHER PROPERTY EVALUATIONS?

Mrs. Shepherd: The County was projected to receive approximately $12 million for the FY25 budget based on $1.06.

TRS: With a reduced rate of $1.04 per $100, about how much of that additional revenue would be returned to taxpayers, vs. how much would remain as extra revenue for the County?

Mrs. Shepherd: $2.4 million will not be billed. [TRS: That can be rephrased as,

“Taxpayers can keep $2.4 million instead of paying that in taxes.”] $9.6 million will be new revenue for FY25 budget.

Mr. Greenway: Should be about $2.2 Million reduction of the new $11.6 million in revenue. Is anyone catching the increase of $9.4 million in new revenue to the government this year?

TRS: Does the Code of VA have a limit on what percentage real estate taxes can go up, either by rate increase or assessment percentage, that requires a BOS vote to approve?

Mrs. Shepherd: No.

Mr. Greenway: I’m not sure of the answer but hopefully we aren’t planning in real estate tax increases. I certainly would NOT support a rate increase. One of my properties had an increase of 58%. It’s my opinion we aren’t giving enough back to our citizens this year.

TRS: Lastly, some have made the suggestion, to save expenses, for example the County Human Resources (HR) Department could merge with the County schools’ HR Department, to reduce overlap. Do you have any statement on that or other areas where the County could cut costs in order to ease the burden on taxpayers?

Mrs. Shepherd: The County has a variety of shared services with Roanoke County Public Schools. We always look for opportunities for savings and efficiencies.

Mr. Greenway: I have already spoken to one Board of Supervisor member where there are certainly opportunities to reduce expenses through working together with both boards (School and County). HR, maintenance, transportation, etc. It may not work in all instances but we can start a process of working together to save money for our citizens.

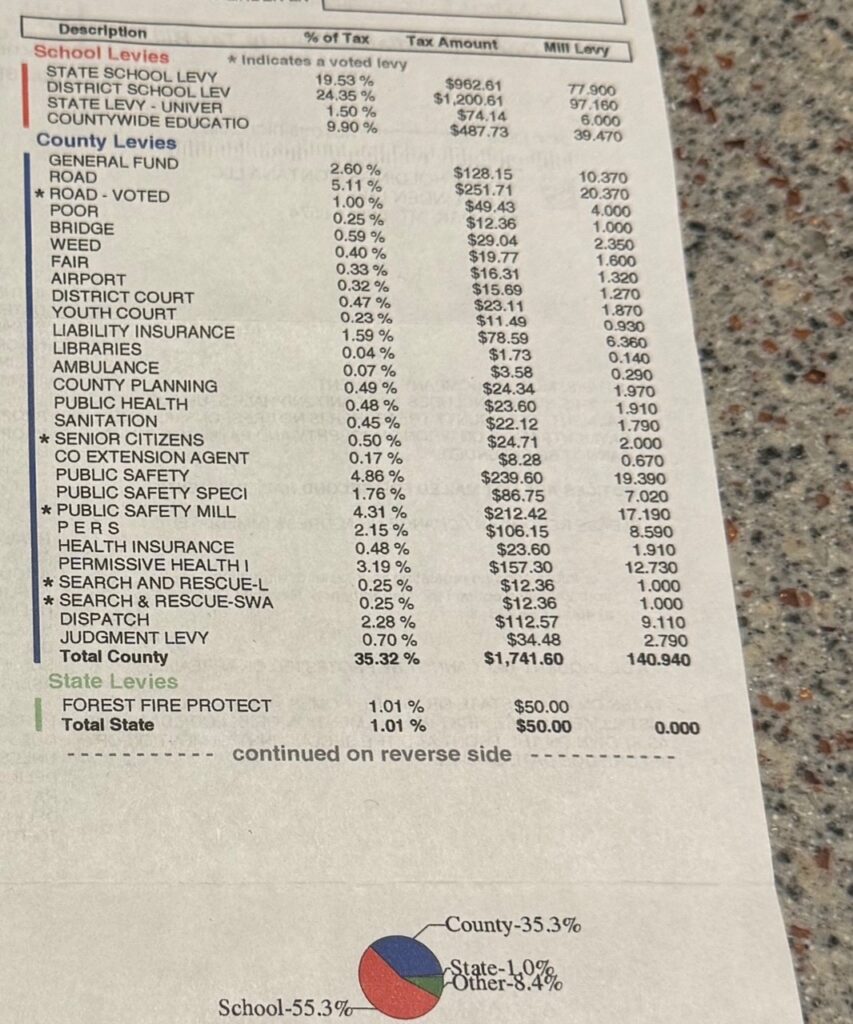

TRS: As posted here, below is a photo of a letter that Lake County, Montana includes with all its real estate tax bills, so residents see the percentage and dollar amount of where their tax dollars go. If elected, would you promote Roanoke County adding such information to future tax bills, starting next year, to better help residents see where their tax dollars are going?

Mr. Greenway: I will say this…I’m for transparency in any form. This is the government by and for the people we represent.

By phone, Greenway summarized his position as follows. “We received $11.6 million more in revenue, if the projected numbers are correct, and we gave back approximately $2.2 million. We also had an increase in revenue last year from real estate valuations. I thought we were conservatives, and we wanted smaller government and we’d give the money back to the citizens. What am I missing?”

Since Virginia Democrats have given the Old Dominion the earliest voting in the nation, voting for the GOP primary begins May 3 and the final day to vote is Tuesday, June 18.

Sen. Tim Kaine will be seeking re-election to another, six-year term in November; he will face the winner of the statewide June GOP primary.

–Scott Dreyer